In our article, the evolution of NFC Wallet, we outline 20+ years of NFC history and some of major developments in mobile wallet technology. Here, we review where we are now and the growing number of use cases for NFC Wallet:

- Contactless payment cards are familiar to most smartphone users as the first widespread use of NFC in Apple Wallet and Google Wallet. Traditional point-of-sale payment terminals had to evolve to support the necessary updates to the EMV card standards, and are also subject to Payment Card Industry (PCI) security obligations and new Apple protocol requirements, making them complex to update and maintain.

- VTAP technology is designed to be much more flexible than these tightly controlled devices and VTAP readers are aimed at supporting the many other applications for NFC Wallet already being deployed.

- Apple VAS and Google Smart Tap support the contactless migration of membership cards, tickets, coupons and other passes that currently rely on barcodes or QR codes. These NFC protocols support automatic selection of the correct card, pass or ticket in any scenario, adding to the convenience.

- Apple Wallet Access (using ECP2 and DESFire protocols) is designed for more traditional access control applications that require a higher level of security, typically replacing RFID cards, fobs, PIN pads, and biometrics. Equivalent secure credential solutions are also available via Google Wallet and Samsung Wallet, again using DESFire as the most popular underlying technology.

- Mobile driving licenses (mDLs) are now being rolled out by governments and these can also support the simple, swift, secure NFC user experience for sharing identity data with a relying party. These will soon expand to other identity documents such as passports.

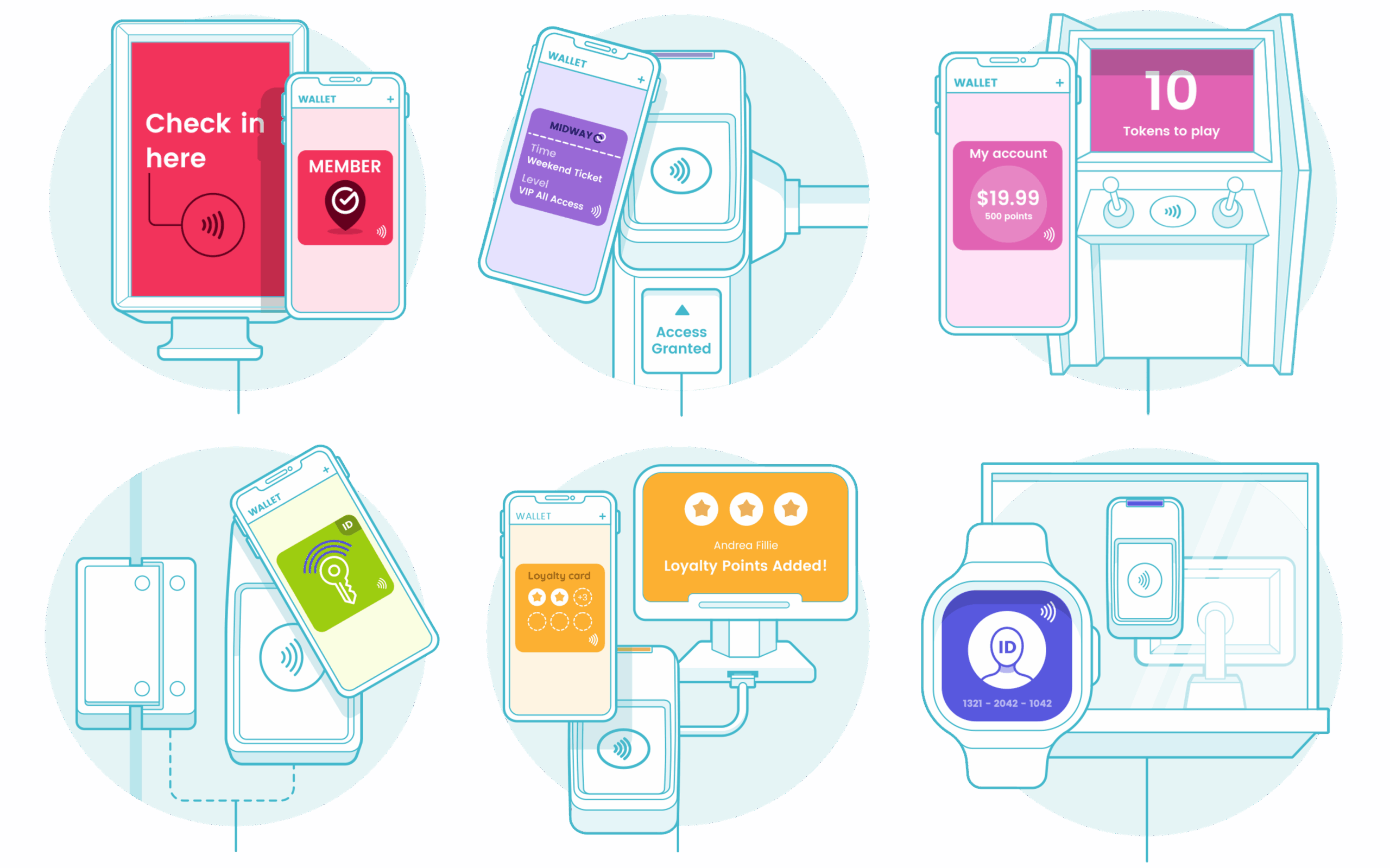

Key uses of NFC Wallet with VTAP

After many years working with NFC Wallet customers globally, we have found it useful to broadly categorise the applications into 6 uses:

Many businesses combine these applications, transforming customer engagement across all their physical customer interaction points.

1. Check-in

Check-in to identify membership status using member number or service credential in all types of public venue. Check-in is the primary use for many ID cards in use today as most are reliant on low security mag-stripe cards, barcodes or QR codes swiped or scanned at point-of-use.

If the risk profile is suitable to match the benefit gained from use, then the free Apple VAS and Google Smart Tap technologies are more than good enough for most environments. In many instances this can be achieved by simply replacing or adding a VTAP reader alongside existing barcode scanners. VTAP readers are easily configured with Apple and Google data & keys, making migration simple. This is working well for gyms, membership clubs, healthcare providers and VIP events.

In many instances, check-in with NFC Wallet can replace the need for other identity checks. Certain government credentials like National Insurance numbers, health IDs and local citizen benefit cards can also be migrated to NFC passes in wallets for convenient check-in to prove service eligibility.

2. Ticketing

Ticketing for entitlement validation and/or access into stadiums, theme parks, event venues and conferences. The upgrade path is straightforward with a VTAP NFC reader replacing, or sitting alongside, existing barcode scanners and/or RFID readers. VTAP reader boards or modules can be embedded into turnstiles, gates and handheld devices, and a standard VTAP reader can be simply plugged into a PC. Football clubs are leading the way, including FC Porto in Portugal and La Liga in Spain.

Whilst many tickets are used in Apple Wallet and Google Wallet for travel, the industry has broadly adopted barcode and QR codes, due to continued use of legacy paper tickets and significant investment in scanner infrastructure. Over time, we believe travel and transit ticketing is also going to move to NFC Wallet when fraud risk is large enough to offset the deployment cost of new infrastructure.

The latest Apple Wallet updates for multi-day passes and dynamic ‘event app’ passes give much greater power and utility to NFC tickets, helping to eliminate fraud and improve the visitor experience. This new convenience functionality for tickets stored in wallets blurs the line between a traditional event app and a ticket, creating new opportunities for venues to innovate their frictionless visitor experience.

3. Access control

Traditional access control is being reinvented by migrating RFID cards, fobs, biometric and PIN entry codes to passes and credentials in NFC Wallet. VTAP readers support Apple VAS and Google Smart Tap for access into lower risk public venues. Linking access passes to specific users’ devices with Apple iCloud or Google Account binding can enable some medium-security uses like 24/7 access to gyms or other semi-public locations. Plus Apple ECP2/Access and Google HCE/SE are available for higher security access control uses.

Many public locations like gyms, events venues and sports arenas are opening member access via free Apple VAS and Google Smart Tap, often in combination with check-in at the front desk. When combined with IP-connected readers and VTAP Cloud, gym member management systems (MMS) can now flexibly control access rights in real time, without the need for local access control infrastructure.

Other locations, such as student campuses, offices, hotels and multi-family homes, can use our Apple ECP2/Access certified readers, connected to smart digital credential issuance systems, for enterprise grade security. Credential management systems combined with NFC Wallet infrastructure support the full lifecycle of access credentials, including simple processes for self-service enrolment and for blocking lost or stolen devices and their replacement.

Depending on the existing access control infrastructure in place, VTAP technology comes with a huge range of integration options, including Wiegand, RS485, OSDP, USB and serial connectivity. Businesses can decide whether to simply replace old readers, modernise infrastructure or maintain a hybrid approach. And they are not locked in to a single source of credentials.

4. Loyalty

Loyalty is being upgraded to make the retail and hospitality loyalty check-out experience more closely aligned with ‘just tap’ payments. Apps and QR codes are the current ‘state-of-the-art’ for retail loyalty schemes, taking advantage of existing barcode scanning infrastructure, but are not frictionless.

NFC Wallet loyalty works alongside existing apps, doesn’t need Wi-Fi or mobile signal, and automatically selects the right card for use. VTAP readers also support Bluetooth beacons, allowing useful notifications to customers’ wallet passes when nearby.

VTAP readers directly connect existing point-of-sale infrastructure alongside payment terminals and scanners (using USB, Bluetooth, network or serial connectivity), providing a more cost-effective upgrade path than replacing legacy hardware.

Our IP-connected VTAP readers can also connect directly to loyalty and CRM platforms, to enable new points of interaction anywhere in physical stores, for new data insights, engagement opportunities and to influence customer spend.

5. Payment

Contactless payments, with Apple Pay, Google Pay and Samsung Pay, are the primary use of NFC and the mobile wallet app on smartphones. Apple Pay was first launched in 2014 and just over ten years later there are approaching 1 billion active users! These ‘open loop’ NFC payments with bank issued cards rely on the global EMV standard which sets very stringent requirements on payment accepting terminals.

The mobile wallet app is quickly and easily opened with the default card payment ready after a seamless biometric verification, proving the identity of the payment card holder. Making a payment is just a simple tap on or near a contactless payment terminal and it even works without the need for Wi-Fi or phone signal. VTAP applies the same user experience to ALL other NFC-enabled cards in the mobile wallet, including any payment method that is not EMV-based.

Stored value ‘closed loop’ payments are perfect for EV charging, cashless vending, coffee clubs and family entertainment centres. These account-based payment methods are just as frictionless, but more flexible and more cost effective than open loop payments.

Open banking, alternative and app-based e-wallet payments can also work with VTAP readers with an NFC tap replacing the need to scan QR codes from within an app to process payments.

6. Identity

Personal, corporate, student and government ID cards are becoming increasingly mobile. Many organisations are deploying digital identities into apps and wallets to make accessing their services frictionless and more secure. The advent of mobile driving license (mDL) technology for government-issued identity cards will enable a wide range of new applications including age verification, frictionless travel and proof-of-identity for service enrolment.

Digital identities and credentials can be stored in Apple Wallet and Google Wallet for use with ‘just tap’ NFC. VTAP readers are used for many large scale NFC Wallet ID applications today, including membership ID for check-in, access control, loyalty and ticketing.

Governments are implementing citizen mobile ID cards based on the global standard (ISO1803-5). Many US states are working with Apple and Google to put IDs into the mobile wallet using NFC, supporting age verification and inter-state travel. The EU is working on specifying an EU-wide wallet app for all types of national ID cards, with a focus on data privacy and security. Other governments like UK, Australia and New Zealand are rolling out wallet apps containing mDL (and other mDoc compliant) data for law enforcement, age verification and KYC checks.

ISO18013-5 defines several implementation options for ID verification, including scanning a QR code in a smartphone ID verification app, using NFC and Bluetooth for fast data reading, and optional online status validation. VTAP PRO readers support NFC, Bluetooth and IP connectivity as standard and can control external QR code scanners, providing the essential building blocks for any new mobile ID verification solution.

VTAP is a highly flexible and future-proof NFC mobile ID reader that will support the various new digital identity applications and regional implementations as the market evolves.

There is much more to come, but so much we can help you do today to make all your customers’ interactions simple, swift & secure… just VTAP!